Harley Davidson CEO Matthew Levatich talks with President Donald Trump on the South Lawn of the White House, February 2, 2017. (Photo by Drew Angerer/Getty Images)GETTY IMAGES

Just two weeks after being inaugurated, President Trump welcomed Harley-Davidson executives to the White House and showered it with compliments, saying, “So it’s great to have Harley-Davidson. What a great, great group of people and what a fantastic job you do.” He added, “Harley-Davidson is a true American icon, one of the greats,” and “So thank you, Harley-Davidson, for building things in America. And I think you’re going to even expand—I know your business is now doing very well.

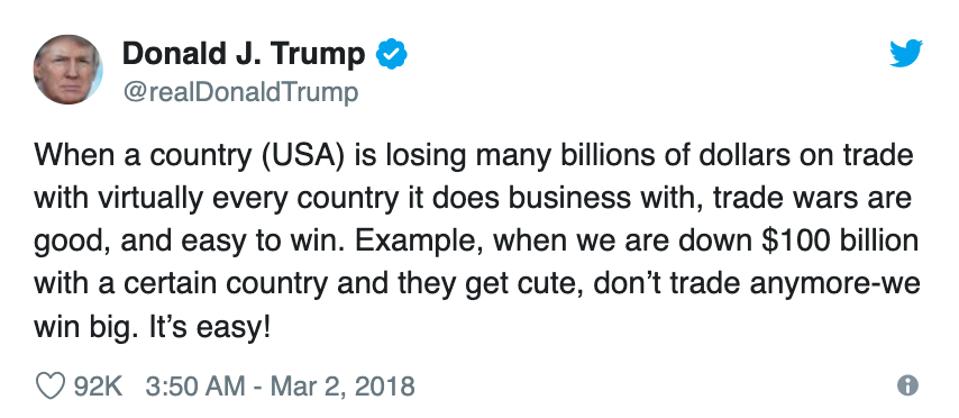

In March 2018, Trump imposed a 25% tariff on steel and 10% on aluminum imported from the European Union. Trump tweeted that “trade wars are good, and easy to win.” Even if Harley-Davidson only used U.S.-produced steel, the prices it paid would be higher, as domestic producers could raise prices.

A classic Trump tweetTWITTER

In retaliation, the EU increased the tariffs on motorcycles from 6% to 31% on June 22 (which added $2,200 to the average cost of a Harley-Davidson), and a few days later Harley-Davidson announced that it would be moving some production out of the U.S. to avoid the higher tariffs.

On its July 2019 earnings conference call, Matt Levatich, Harley-Davidson’s CEO, said, “It was just over a year ago when the European Union imposed significant incremental tariffs on Harley-Davidson motorcycles made in the U.S. and exported to the EU, driving tariffs from 6% to 31%, tariffs that are scheduled to increase to 56% in 2021. We acted decisively and established our primary path to leverage our Thailand operations still under construction at that point to get tariffs back to 6% as soon as possible.”

How the worm turns

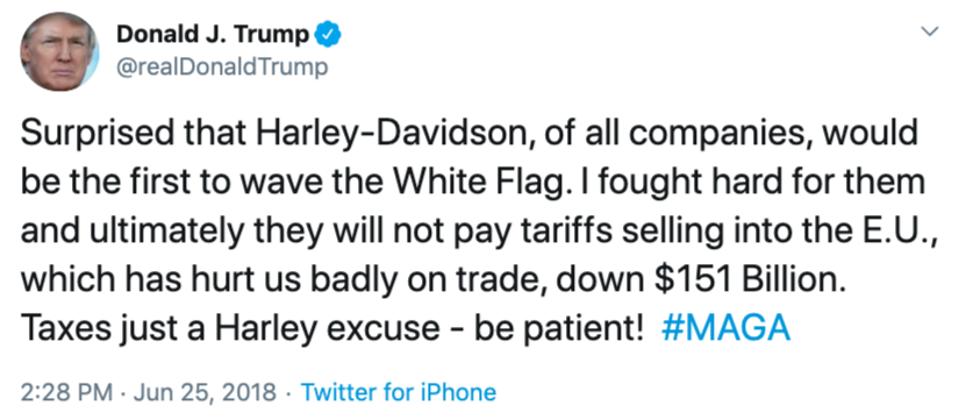

To lessen the impact of the EU tariffs Harley-Davidson announced in June 2018 that it would be moving some production out of the U.S. as the EU and U.S. tariffs would cost the company over $40 million in additional costs in 2018. Not surprisingly Trump was not happy and tweeted out.

Another tweet from President Trump TWITTER

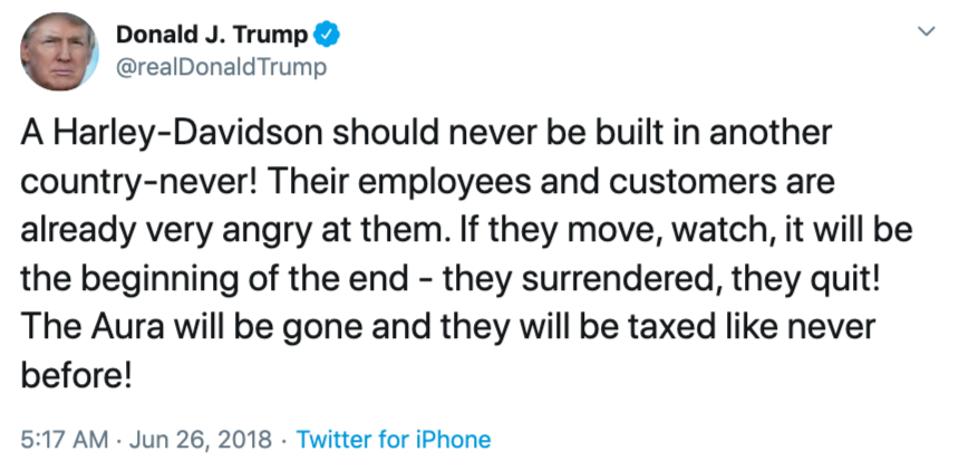

He followed a day later with:

Another President Trump tweetTWITTER

Either Trump does not understand how companies need to react to the tariffs he has implemented or has decided to ignore the consequences of them.

Unlike soybean farmers who have been badly hurt by China’s retaliatory tariffs as farmer bankruptcies and suicides have increased, Trump has not sent any of the tariff money the U.S. has received to Harley-Davidson.

Revenue, earnings and valuations all dropped

Circle back to Trump’s comments when he met with Harley-Davidson in 2017. He said, “I think you’re going to even expand—I know your business is now doing very well.” Nothing could be further from the truth as some manufacturing has been moved overseas, revenue and profits have declined, and the company’s market cap has fallen almost 20%.

Between the first half of 2018 and the first half of this year Harley-Davidson has seen its revenue, earnings and valuation metrics all fall. The declines may not be totally attributed to Trump’s tariffs and the EU’s reaction, but they probably accounted for a large portion of the reductions.

Revenue

- First Half 2018: $3.26 billion

- First Half 2019: $3.02 billion, down $238 million or 7.3%

Gross Margin

- First Half 2018: 42.2%

- First Half 2019: 39.4%, down 2.8% or 280 basis points

Operating Income

- First Half 2018: $560 million

- First Half 2019: $423 million, down $137 million or 24.5%

Net Income

- First Half 2018: $417 million

- First Half 2019: $324 million, down $93 million or 22.3%

EPS

- First Half 2018: $2.48

- First Half 2019: $2.03, down $0.45 or 18.1%

Market Cap

- First Half 2018: $7.1 billion

- First Half 2019: $5.7 billion, down $1.4 billion or 19.2%

PE Multiples

- 2016: 15.2x

- 2017: 16.8x

- 2018: 10.7x

- 2019: 12.9x estimated

- 2020: 9.9x estimated

Shares are back down to 2012 levels

Harley-Davidson’s shares came close to an all-time high a few months after Trump was elected. However, the company’s earnings tumbled in 2017 from $3.83 in 2016 to $3.02 in 2017, which is probably the main reason the stock declined in 2017 and early 2018.

EPS rebounded a bit in 2018 to $3.19, but as outlined above, Trump’s trade wars have negatively impacted Harley-Davidson’s results, which has led the stock to hit lows not seen since 2012 when the company was clawing its way out of the Great Recession.

Harley-Davidson stock chartSTOCKCHARTS.COM